Stamp Duty

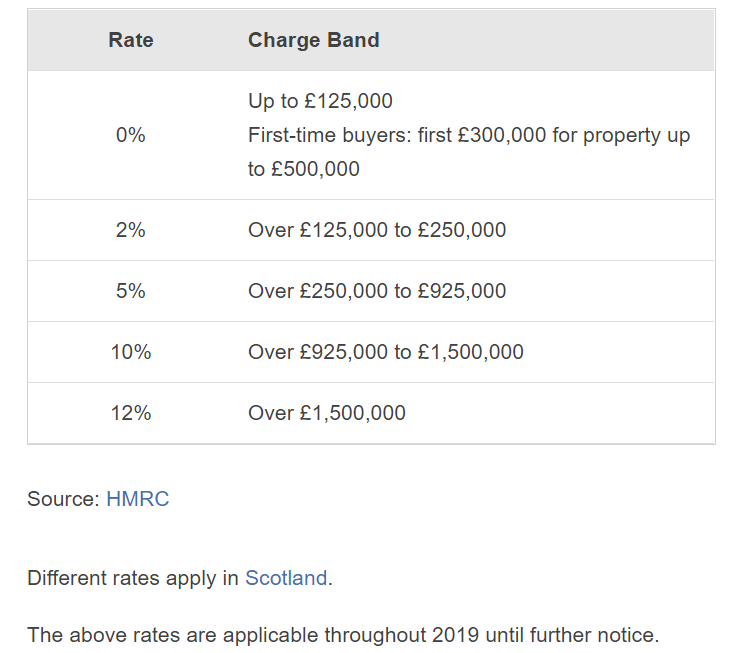

Stamp Duty Rates are set by the UK government, which are then payable to HM Revenue and Customs (HMRC) on completion of a property transaction. The current percentages range from 0% (up to £125,000) to 12% for values over £1.5 million.

Stamp duty is quite possibly the biggest expense you’ll face when buying a property in the UK along with the mortgage but stamp duty is also payable on stock and share transfers. There are many myths surrounding these duties, so we thought the following might help to de-mystify the situation.

Whilst stamp duty is an extra cost burden that home buyers face, the good news is that from 22nd November 2017, first-time buyers have not had to pay any stamp duty on the first £300,000 for property purchases up to £500,000.

To put this in context; there is no tax to pay up to £300,000 and then 5% is payable on the portion from £300,001 to £500,000. If the property exceeds £500,000, then the standard rates apply.

The chart that follows shows the various thresholds and the amount in percentage terms that are currently payable through 2019 and until further notice.

Stamp Duty Calculator

Use the calculator below to see the stamp duty liability on your next property transaction. Only check the boxes if you are a first time buyer of if purchasing a second home or buy to let – otherwise just enter the amount and click calculate.

Stamp Duty:

Please note: The calculator above is provided by a third party and should only be used as a guide. Contact us to ensure the exact amounts that apply.

Quick Links

Get in touch

Find out what we can do to help you with your finances. Get in touch with us today!

Credit report review service

Understand your credit report.